- ABOUT US

- TAX SERVICES

- RESOURCES

- CAREERS

- (888) APRIL-15

- BOOK NOW

- CLIENT LOGIN

- FIND A TAX OFFICE

- (888) APRIL-15

- BOOK NOW

- PRICING & PROMOTIONS

- TAX SERVICES

- ABOUT US

- RESOURCES

- CAREERS

- CLIENT LOGIN

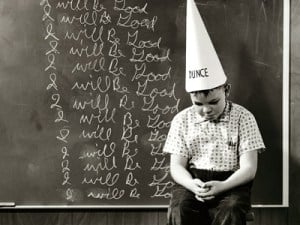

NY State To Humiliate Tax Fraudsters

In these tough times for state and municipal governments, the Department of Taxation and Finance wants to make sure it’s not losing a single dime. To that end, it’s focusing on multiple techniques, including public spiritedness and humiliation.

The department has created a page to help taxpayers report people and businesses who, allegedly, are not taxpayers. Via phone, fax, mail or online form, those who suspect misbehavior can make an “information referral” against an individual, business or a tax preparer/practitioner. The state promises to keep all information confidential. Infractions may include the following, according to the department:

- Failing to report income

- Failing to file a return

- Failing to remit monies collected

- Selling untaxed liquor, motor fuel or cigarettes

Meanwhile, the department has created an electronic public square for those who are already in trouble. It is publicly listing the top 250 warrants—in both business and personal categories—that were filed in the last 12 months, ranked by amount of tax owed.

Source: NYSSCPA