- ABOUT US

- TAX SERVICES

- RESOURCES

- CAREERS

- (888) APRIL-15

- BOOK NOW

- CLIENT LOGIN

- FIND A TAX OFFICE

- (888) APRIL-15

- BOOK NOW

- PRICING & PROMOTIONS

- TAX SERVICES

- ABOUT US

- RESOURCES

- CAREERS

- CLIENT LOGIN

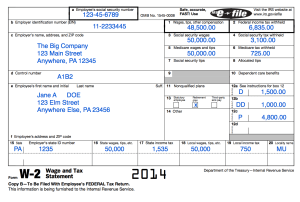

Getting to Know Your W-2 Form

The Internal Revenue Service (IRS) requires all employers to provide employees with a W-2 form, which lists the employee’s income information for the previous year. It doesn’t matter how long you worked for the company; if you earn more than $600, your employer must issue you a W-2. If any of your wages were withheld for Social Security or Medicare, the employer must issue a W-2 no matter how much you earned. Employers are required to provide you with this information by January 31 so that you can complete your tax return by April 15. Once you have your W-2 in hand, it’s time to get to know the form so you can be sure you don’t make any errors in reporting your income taxes.

What Each Box on the W-2 Means

When your W-2 arrives, check it to make sure that your social security number is listed correctly. The boxes on the left of the form should list your employer’s name and address, as well as your name and address. Directly below your social security number is your employer’s identification number. This number must be entered on your tax return.

Each of the boxes on the right side of your W-2 should have a number. Box 1 indicates the total salary you received, less any tax-exempt or tax-deferred benefits. This includes health insurance, dental insurance, retirement savings, and the cost of most other benefits that your employer deducts from your paycheck. Box 2 is the total amount of income tax withheld by the federal government. Box 3 indicates your total wages subject to the Social Security tax, including amounts not listed in Box 1. This number could be higher than the one in Box 1, because it’s calculated before payroll deductions. Box 5 indicates wages subject to Medicare taxes; since there is no cap for Medicare taxes and they generally don’t include any pretax deductions, this number might be bigger than the one in Box 3.

Boxes 4 and 6 indicate how much you paid for Social Security and Medicare taxes, respectively. The amounts are calculated based on a flat rate: 1.45% for Social Security and 6.2% for Medicare. That means that the numbers in Boxes 4 and 6 should be equal to the amounts in Boxes 1 and 3 multiplied by 1.5 and 6.2 Boxes 7 and 8 reported wages earned from tips; if you don’t report tips to your employer, these boxes will be empty. Box 9 actually no longer serves a purpose; the reporting requirement that made Box 9 necessary expired a few years ago, but the box has yet to be removed from the form.

If your employer paid any dependent care expenses on your behalf, you will see the total amount in Box 10. In Box 11, your employer lists any amounts distributed to you during the year from its non-qualified deferred compensation plan. Box 12 is pretty complicated, and involves entering different codes, only some of which are taxable. For a better explanation of Box 12, it’s best to go straight to the source and read what the IRS has to say about it. Boxes 13 and 14 will be filled out by your employer to indicate if you’re a statutory employee, if you participated in your company’s retirement plan or if you received sick pay from a third-party insurance policy.

Boxes 15 through 20 are information you need to file your state income tax return. This includes your state’s two-letter abbreviation, your employer’s state identification number, your income subject to state taxes (including that which is currently exempt from federal taxes), the amount of state income tax withheld from your paychecks last year, your local wages, local taxes, and the locality name where you paid them. It’s not common for figures to appear in the last three boxes.

What to Do if You Don’t Receive a W-2

If you haven’t received your W-2, make sure your employer mailed it to the correct address. If it was returned to your employer as undeliverable, request a new one and then wait until February 14. At this point you will need to contact the IRS and provide your full name and social security number, your employer’s complete address, your employer’s telephone number, and your estimated wages and tax paid for last year. If you haven’t received a W-2 by April 15, use Form 4852, Substitute for Form W-2, Wage and Tax Statement to file. Should you receive your W-2 after you have filed, use Form 1040X to send the correct information.