Join our team of experienced tax professionals at R&G Brenner! We're hiring CPAs, EAs, office managers, assistants, and building maintenance staff. Apply now for exciting opportunities in tax and accounting services.

7 Tax Tips: Standard Deduction Vs. Itemized Deduction

The answer to the question is clear: “whatever gets me back a bigger refund”. But how do you know when it is beneficial to itemize your deductions over taking the standard deduction? Each year, thousands of taxpayers miss out of millions of dollars in additional refunds because they make a mistake in this area–usually because they choose the standard deduction over itemizing. The two major reasons for making this mistake is 1) they are used to filing tax returns with the standard deduction and adding a Schedule A to a tax return is more complicated and may cost “more” and 2) they do not take into account recent recent changes in lifestyle like a new mortgage for a house.

While it may be more of an expense in time & money, these are usually short term expenses, and itemizing your deductions could easily make up for those additional expenses in the long run. The following list can help determine whether itemizing or taking the standard deduction is the way to go for you.

1. Qualifying expenses Whether to itemize deductions on your tax return depends on how much you spent on certain expenses last year. If the total amount you spent on qualifying medical care, mortgage interest, taxes, charitable contributions, casualty losses and miscellaneous deductions is more than your standard deduction, you can usually benefit by itemizing.

2. Standard deduction amounts Your standard deduction is based on your filing status and is subject to inflation adjustments each year. For 2011, the amounts are:

- Single $5,800

- Married Filing Jointly $11,600

- Head of Household $8,500

- Married Filing Separately $5,800

- Qualifying Widow(er) $11,600

3. Some taxpayers have different standard deductions The standard deduction amount depends on your filing status, whether you are 65 or older or blind and whether another taxpayer can claim an exemption for you. If any of these apply, use the Standard Deduction Worksheet on the back of Form 1040EZ, or in the 1040A or 1040 instructions.

4. Limited itemized deductions Your itemized deductions are no longer limited because of your adjusted gross income.

5. Married filing separately When a married couple files separate returns and one spouse itemizes deductions, the other spouse cannot claim the standard deduction and therefore must itemize to claim their allowable deductions.

6. Some taxpayers are not eligible for the standard deduction They include nonresident aliens, dual-status aliens and individuals who file returns for periods of less than 12 months due to a change in accounting periods.

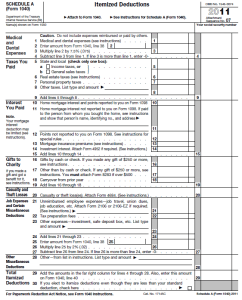

7. Forms to use The standard deduction can be taken on Forms 1040, 1040A or 1040EZ. To itemize your deductions, use Form 1040, U.S. Individual Income Tax Return, and Schedule A, Itemized Deductions.

Note: If you are itemizing you deductions for the first time, it is highly recommended that you hire a tax professional to assist you as the Schedule A is one of the forms currently under scrutiny from the IRS. It is very easy to overstate deductions if you are not careful about what expenses are “qualifying expenses”. For help in itemizing your deductions, contact an R&G Brenner tax pro today.

Source: njtoday.com