Join our team of experienced tax professionals at R&G Brenner! We're hiring CPAs, EAs, office managers, assistants, and building maintenance staff. Apply now for exciting opportunities in tax and accounting services.

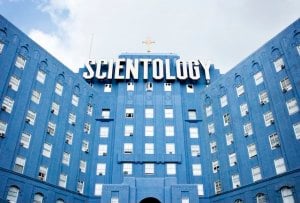

After Documentary, Scientology’s Tax-Exempt Earnings Attracting Attention

The Church of Scientology is getting a lot of attention these days thanks to “Going Clear”, HBO’s recent documentary on Scientology and a number of its practices. One aspect of Scientology which is receiving even more attention than before is the church’s tax-exempt status. Part of the controversy extends to how the Church of Scientology actually received its tax-exempt status—and to just what ends it uses it. After being hit with over 2,400 lawsuits at once from Scientologists, the IRS, after years of rejecting Scientology’s requests for a change in their tax status, gave it tax exemptions typically applied towards churches in 1993.

Tax Exemptions All Around

While the Church of Scientology hasn’t issued a clear response to questions raised by the documentary, one thing that’s definitely not in question is whether Scientology is making use of its tax-exempt status. Fortune’s Chris Matthews, citing the Scientology news website The Scientology Money Project, estimates that the Church of Scientology is worth somewhere in the area of $1.75 billion, with most of that money wrapped up in real estate. About 70% of that real estate is tax-exempt, meaning that a change in tax could possibly land the church a tax bill of $20 million or so a year.

Matthews cites a number of different sources which make a compelling case that Scientology uses its tax-exemption in ways that are clearly commercial, with examples such as a Tampa Bay Times investigation from 2010 which discovered that Scientology had not been paying a 5% occupancy tax for years. It turns out that Scientologists visiting the head offices in Clearwater were staying at hotels owned by Scientology without paying the tax. It is cases such these, now becoming increasingly visible as more similar stories emerge, that are keeping the debate surrounding Scientology’s tax-exempt status alive in the public.

Against the Public Interest?

In a recent interview with The Wrap, Alex Gibney, the director of Going Clear, noted that the main argument against Scientology losing its tax-exempt status was not predicated on whether or not it’s a “real” church, but rather that Scientology wields its tax-exempt status in order to pursue policies which are not in the public interest. In his documentary alleging that people working for the Church of Scientology often earn as little as 40 cents an hour and accusing the Church of illegal imprisonment and torture at the highest levels, Gibney’s central argument departs from the usual tack: that Scientology isn’t a real religion. Gibney argues instead that the religion is a public threat.

While tax exemption is hard to get, it’s also extremely hard to lose, and the IRS will require a great deal of proof of the claims like those made in the documentary and those from former church members who see themselves as victims of a cult. The Church of Scientology reportedly keeps files on all its members to use against them in case they leave the church, making getting that proof even more difficult than it otherwise would be. The evidence presented in Going Clear is damning, but it hasn’t cost Scientology its tax-exempt status—yet.