Join our team of experienced tax professionals at R&G Brenner! We're hiring CPAs, EAs, office managers, assistants, and building maintenance staff. Apply now for exciting opportunities in tax and accounting services.

H&R Block Files Client’s Tax Returns Early Delaying Refunds

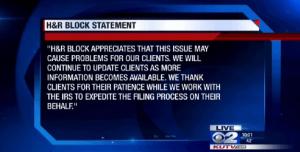

H&R Block (HRB)–the largest public retail tax preparation company in the United States–has confirmed that they have filed many tax returns containing certain delayed credits too early, causing their clients refunds to be delayed. The primary issue is the Education Tax Credit which was not accepted for electronic filing until recently (February 22nd). This has prompted the IRS to send letters to HRB clients instead of their expected refunds. HRB has released the following statement:

“H&R Block has confirmed with the IRS that there was an issue with certain tax returns filed before February 22, 2013 that included certain education tax credits claimed on Form 8863. We have worked with the IRS to expedite a solution to this issue for all of our affected clients.”

If you are a current HRB client, and have received notification from the IRS concerning the early filing of your tax return–or you think you may be affected–it is advised that you contact your local HRB office, or contact their executive headquarters by calling 1-800-HRBLOCK.

Source: ABC