Automatic Tips To Be Treated As Taxable Wages

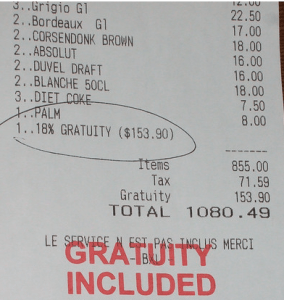

We’ve all been out to a restaurant and received a bill where gratuity–usually around 18%–was included in the bill. This routinely occurs when larger groups dine together. However, this practice may be going extinct as a change in the tax rules starting January 1st, 2014 will view automatic gratuities as a “service charge”, which opens them up to be taxed as wages.

Any way you look at it, this is not good news for employers, and especially employees that depend on tips for their lively hood. Employers would be subject to more paperwork and more responsibility to accurately report their employee’s wages to taxing authorities; potentially opening them up to payroll audits if they continue the practice of automatic gratuities, but are not vigilant reporting these “tips” as wages. Or they simply can eliminate automatic tips all together, and have all dining parties (regardless of size) tip their servers the traditional way. The later appears to be the choice that many large restaurant chains are making:

[Olive Garden, LongHorn Steakhouse and Red Lobsters] stopped automatic tips at 100 restaurants in four cities, where it is testing a new system in which the restaurants include three suggested tip amounts, calculating for the customer the total with a 15%, 18% or 20% tip on all bills, regardless of party size. Diners can opt to tip more or less than the suggested amounts, or to not tip. Depending on how patrons react and how well the new software system works, Darden [Restaurant Inc. which owns all three restaurant chains] may switch to such suggested tips at all of its restaurants…”I think the vast majority of restaurant owners will discontinue the practice,” says Denise Wheeler, an employment attorney in Fort Myers, Fla., who represents several restaurant chains.

It’s a ‘Damned if you do, Damned if you don’t’ scenario for servers. On the one hand, if their employer decides to keep automatic gratuities, their tips become wages and subject to withholding thereby guaranteeing they do not see their full 18% tip. On the other hand, eliminate automatic gratuities and patrons might not tip as much as they would had the tip been included…not to mention the potential for arguments over tips between servers and patrons also increases:

Restaurants adopted automatic gratuities to help ensure that their servers—whose tips supplement a salary that is often less than the federal minimum wage of $7.25 an hour—weren’t stiffed on large tabs. But many servers are likely to support dropping the practice because they don’t like the idea of their tips being treated as wages, which requires upfront withholding of federal taxes, and means they won’t see that tip money until payday.

“I don’t want my tips to be on my paycheck as a wage. I like to get my tips at the end of my shift because I know what I’m getting right away,” says Tamie Cordoba, a 54-year-old server at a LongHorn Steakhouse in Jacksonville, Fla.

Ms. Cordoba makes base wages of $4.25 an hour, or $144.50 to $161.50 for her average workweek of 34 to 38 hours. She said she usually makes an additional $500 to $650 a week in tips. Since she never knows exactly how much she will get each week in tips, getting paid at the end of each shift helps her budget, Ms. Cordoba said. “In this industry, that’s what we live on. If I had to wait two weeks I don’t know how I’d survive.

This is another head scratcher from the IRS. While this rule was proposed for 2013, the implementation of the rule was delayed to 2014. The IRS issued a statement that “additional clarification” is recommended concerning this rule. Right now the only thing clear is that hard working lower income taxpayers will again pay the price in the form of lower net income.

We are approaching the 5 year anniversary of the global financial crisis, and the ensuing taxpayer bail-out of the banks that nearly brought down the entire global financial system. This tax rule stands in stark contrast to the countless loopholes that millionaire and billionaire financial executives have access to; the very same executives that caused of contributed to the crisis with their reckless investing and ‘aggressive’ accounting practices. Which again raises this question: Why hasn’t the justice department punished even one of these culprits?

We’d like to hear your comments. What are your thoughts on this tax rule change?

Source: Wall Street Journal