How Do I Know If My Tax Extension Was Accepted?

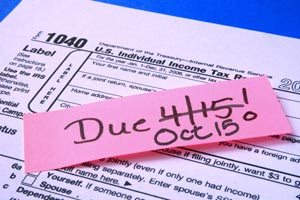

Hardly anyone thinks fondly on tax season, which involves complicated forms and financial stress. For those people who were not able to meet the April 15th tax deadline and filed for an extension as a result, here are the three most important things you need to know.

1. An Extension for Filing Doesn’t Mean an Extension for Payment

It might not make a lot of sense, but just because you’re filing your taxes later than April 15th doesn’t mean you don’t still have to pay your taxes by the April 15th deadline. This is a pretty common misconception, but a tax extension merely gives a person an additional six months to file, making your tax filings due on Oct. 15th. However, in order to be in accordance with the law, you still need to estimate how much money you think you’ll owe for the year and get it to the IRS by April 15th. If you don’t, you may be charged a penalty for not paying by the deadline, and will also accrue interest on any amount that remains unpaid. When in doubt, overpay. Any overpayments will be issued as a refund or as a credit for future tax bills. Otherwise, you’ll still have to pay interest on any shortages due.

2. There Are Electronic Payment Options

While you’re required to pay any and all taxes that are due by April 15th to avoid receiving a tax penalty, you can pay any outstanding balance that’s due past April 15th (with a penalty) electronically if you filed for an extension via the Internet. If you want to do this, you can have your funds automatically withdrawn from your checking account—just make sure to have your bank’s routing number and your personal banking account number on hand when filing.

3. You Need to Make Sure Your Extension Has Been Approved

Before you assume that the IRS has approved your tax extension and you put off filing, you need to make sure that it actually has. In order to know if your tax extension has been received and approved by the IRS, you should check that you received a confirmation email within 24 hours of filing, assuming that you submitted your extension request electronically. On the other hand, if you filed for your extension via mail, then you won’t receive any confirmation from the IRS. However, if your request was postmarked by April 15th, 2014, the IRS will almost always accept it.

If you’ve filed an extension with the IRS, make sure you still pay your estimated taxes due by April 15th, keep in mind that you have some electronic payment options, and double check to make sure your extension has been approved if you are unsure. Additionally, remember that you can still file your taxes electronically anytime between now and Oct. 15th, 2014 if you’ve filed for and been granted an extension. As long as you follow these three tips above, and file your taxes in accordance with the law, you shouldn’t have any problems with your extension. For these and other tax tips, the website for the IRS provides a comprehensive list of dos and don’t for tax filers.