- ABOUT US

- TAX SERVICES

- RESOURCES

- CAREERS

- (888) APRIL-15

- BOOK NOW

- CLIENT LOGIN

- FIND A TAX OFFICE

- (888) APRIL-15

- BOOK NOW

- PRICING & PROMOTIONS

- TAX SERVICES

- ABOUT US

- RESOURCES

- CAREERS

- CLIENT LOGIN

“Real” Vs. “Unreal” Audits. What’s the Difference?

Did I calculate my return correctly? Did I take all the deductions I’m entitled to? Do I qualify for a credit and should I take it? These are all samples of the many questions that cross many a taxpayer’s mind before they submit their returns to the Government. However, one thought–or rather plea–that’s almost always on the mind is: Please, just don’t Audit me.

Much like the fear of spiders & snakes that is deeply ingrained into our reptilian brains, so too is our fear of the IRS. These fears ranges from the absurd–The IRS is going to throw me in jail for not paying my taxes this year–to the plausible–If I’m audited this year, the IRS may look at my prior years. But what exactly is considered an “Audit” by the IRS?

According to the Taxpayer Advocate Service (TAS):

…face-to-face audits of individual taxpayers reporting income over $200,000 increased by 34 percent as compared with FY 2010, from 58,521 to 78,392. Also, the IRS is now auditing about one out of every eight taxpayers who reported over $1 million in income.

Overall, with 140,837,499 individual income tax returns filed in the 2010 calendar year, the IRS conducted and closed a total of 1,564,690 audits in FY 2011, for a “coverage” rate of 1.11 percent. This is about the same coverage rate as in the previous fiscal year, but as noted above, the IRS is increasingly focusing its face-to-face audit resources on more affluent individual taxpayers.

On the surface, this looks like great news to the average taxpayer. It would be logical to think that if just over 1% of the population is getting audited a year, and the bulk of those resources are focused on those taxpayers who make $200,000 or more year, the chances of getting audited are slim to none, right? Well, not so fast.

As reported in the recently released National Taxpayer Advocate’s 2011 Annual Report to Congress, the IRS not only conducted 1.6 million audits of individual taxpayers in FY 2010; it also reached out and touched an additional 13.5 million individual taxpayers during that year in a way that often felt like audits to the taxpayers impacted, even if the IRS doesn’t technically classify all those contacts as “audits.”

These non-audit “touches” focus on a very different group of taxpayers in terms of income level. More importantly, non-audit audits (let’s call them “unreal” audits, as opposed to the ones the IRS considers “real”) do not trigger very important taxpayer protections enacted by Congress over the years to ensure that taxpayers are treated fairly in examinations.

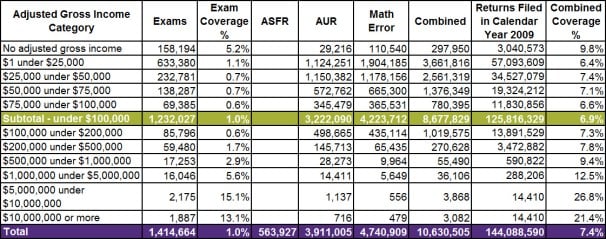

“Unreal” audits last tax year consisted of the following:

- 3,911,005 Automated Underreporter (AUR) cases, in which the IRS matches income reported by the taxpayer on his or her return with income reported to the IRS by third-party payers;

- 4,740,909 math error notices, in which the IRS corrects and assesses mathematical or other inconsistent entries on a return before the taxpayer has a chance to contest the change; and

- 563,927 Automated Substitute for Returns (ASFRs), in which the IRS creates a substitute return for a nonfiler based on third-party payer information.

This equates to 9,215,841 “unreal” audits that the IRS does not designate as actual audits. The graph below compares a taxpayer’s adjusted gross income (AGI) to the type of audit they received. The results a very interesting:

As can easily be seen, the “combined coverage” (which combines the rates of “real” & “unreal” audits) increases the audit rate of certain groups of taxpayers by as much as 1,100%! The bottom line is that while the IRS is reporting an audit rate of 1%, is it actually closer to 7.4%–A seven fold increase!

So why is this important? Firstly, if you look a graph, the vast majority of these “unreal” audits are going to taxpayers that have an AGI of $100,000 or less. Secondly, this masks the amount of work the IRS is actually doing. Thirdly & most importantly:

…the type of contact – whether it’s a “real” or “unreal” audit – makes a difference in the rights afforded taxpayers and also in the halo, or indirect, compliance impact of that contact…

The tax law grants the IRS the authority to examine any books, papers, records, or other data that may be relevant to ascertain the correctness of any return. (See IRC § 7602(a)(1).) The IRS has taken the position that an attempt to resolve a discrepancy between the taxpayer’s return and data available from a third party does not constitute an examination because the IRS is not examining books or records but merely asking the taxpayer to explain the discrepancy. (See Rev. Proc. 2005-32, § 4.03, 2005-1 C.B. 1206.)

When the IRS doesn’t classify these tax adjustments as audits, the IRS doesn’t trigger the taxpayer’s right to avoid unnecessary examinations. (See IRC § 7605(b).) This position enables the IRS to later conduct a “real” audit of a taxpayer who already has been subjected to an “unreal” audit of the same return.

From the IRS’s perspective, it is important to preserve its ability to conduct “real” audits because these “unreal” audits typically focus on limited issues such as an omitted income item. But from the taxpayer’s perspective, being contacted by the IRS more than once about one year’s return can feel like…well…at least one time too many.

This distinction takes on added significance when we consider that the overwhelming majority of taxpayers who are subject to “unreal” audits are low income or middle class, and these taxpayers are least able to afford representation in resolving their disputes. They may not even know when their rights are being violated. (Read our recommendation about creating a Taxpayer Bill of Rights.)

In addition, the IRS is likely to start conducting “unreal” audits of business taxpayers, including self-employed individuals, by matching income reported on tax returns against third-party reports of gross receipts submitted by issuers of credit and debit cards. (See IRC § 6050W.) Any resolution of mismatches will most assuredly require the IRS to review the taxpayer’s books and records. Yet because the IRS doesn’t consider these Automated Underreporter contacts to be “real” audits, the IRS will retain the right to conduct a second review of the taxpayer’s books and records for the same tax year. I cannot believe that Congress, in enacting the protections of IRC § 7605(b), contemplated this result.

Moreover, this report does not consider “unreal” audits by the States; New York in particular has used a “pre-refund” letter (in effect, an “unreal” audit) for at least the last 4 years. NY does this on their own, however, the IRS routinely notifies other States if they make an adjustment to a taxpayers federal return, and the state then sends their notifications of adjustments.

The TAS’s recommendation to treat all audits as equal would go a long way to tighten up the criteria at the IRS if it would limit the amount of times they could review a return. It would also almost certainly reduce the amount of “unreal” audits for those without the means or the time to defend themselves affectively. Thus, R&G Brenner wholeheartedly agrees and supports the TAS’s proposed changes.

Source: Taxpayer Advocate Service